By Frank Andorka, Senior Correspondent

What Happened: SEIA and GTM Research finally closed the book on 2017 with the release of their U.S. Solar Market Insight report, which indicated the following (quoting directly from the release)

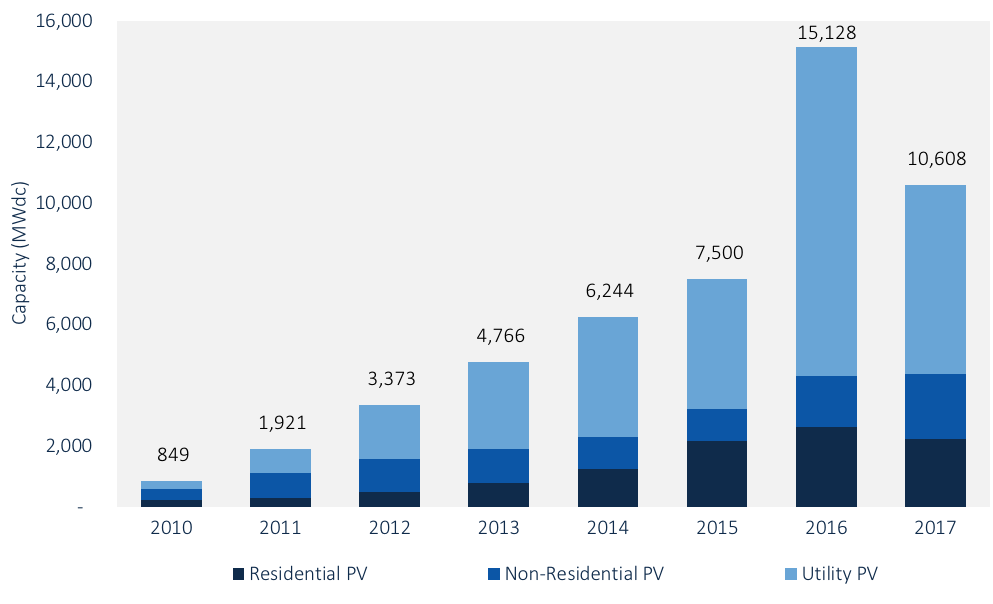

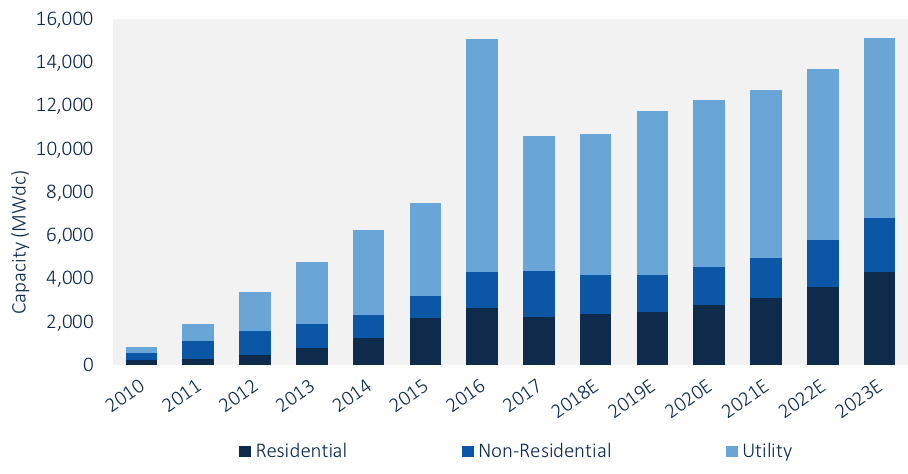

- In 2017, the U.S. market installed 10.6 GW-DC of solar PV, a 30% decrease year-over-year from 2016.

- In 2017, 30% of all new electric generating capacity brought online in the U.S. came from solar, ranking second during that period only to natural gas.

- Q4 2017 saw price increases in most PV market segments stemming from increases in module costs. This was due to a global shortage of Tier 1 module supply and the uncertainty spurred by the Section 201 petition. But the price increases were mitigated by falling prices in racking and inverters, improving operating efficiencies and likely margin compression.

SolarWakeup’s View: It’s never easy to step into a legend’s shoes. Who would want to follow in Jerry Rice’s shoes? Or be the next small forward in Cleveland after LeBron? Or trying to pitch in Los Angeles after Clayton Kershaw ends his mastery on the mound?

So let’s be real: 2017 never really had a chance.

Following a record-breaking 2016 in terms of installed solar capacity, it was inevitable that 2017 would fall short in comparison – and that’s just what the most recent SEIA/GTM Research U.S. Solar Market Insight report did show.

Installed capacity: Off 30%. Price increases. A residential market in seeming freefall, and a utility-scale sector trying to rediscover its footing in the swirling uncertainty of the tariff debate.

Based on the tumultuous and uncertain status of the solar industry last year, some industry observers said the drop in installed capacity was exactly what they expected.

“I wasn’t surprised when I saw the numbers came out,” said Mathew McGovern, CEO of Cypress Creek Renewables, a nationwide developer that has been intensely active in protecting PURPA and net metering in states across the country. “The market froze mid-year when 201 hit industry consciousness, then panel prices jumped.”

Daniel Shugar, CEO of NEXTracker, said the U.S. market fell because of the uncertainty surrounding how large the tariffs Trump seemed hellbent on imposing would be – an uncertainty that wasn’t resolved until January.

“It’s not rocket science,” Shugar said. “Until January, no one knew how much tar

iff penalty would be imposed on PV module costs. As a result, many projects were deferred.”

“Some projects died due to the added cost of modules, but fundamentals are still strong for the industry to rebound in 2019,” Shugar added.

The reduced percentage of installed capacity can’t solely be blamed on the tariffs, however. Costa Nicolaou, CEO of PanelClaw, said 2017 suffered from the hangover from the last federal policy fight over the investment tax credit (ITC).

“There was a lot of demand pull-in in utility scale at the end of 2016 because everyone assumed the ITC would end in 2016, so they moved their project timelines up significantly to make sure they could take advantage of it,” Nicolaou said. “Even despite that, 2017 had all the hallmarks of being a great year – then the Section 201 complaint was filed, and that dumped a bucket of ice water on our fire.”

But there is some good news in the report. After all, even though it doesn’t equal 2016’s incredible numbers, the industry did still install 10.6 GW last year. Furthermore, while the residential sector is cratering in many states and the utility-scale market is faltering, the commercial and community markets grew 28%, marking its fourth straight year of significant increases.

“We are excited to see commercial solar be one of the driving forces behind the continued growth of the industry,” said Tony Clifford, chief development officer for Maryland-based Standard Solar. “While no one expected last year to be as big as 2016, 10.6 GW is still a great accomplishment, especially in the face of such uncertainty.”

“This is yet more proof that the solar industry is on such solid footing that even difficult circumstances can’t hinder its growth,” Clifford said.

Jesse Grossman, CEO of Soltage, a New Jersey based developer of commercial

“We were heartened to see this report today, showing that solar continues to post strong annual build numbers even in years with stiff headwinds,” said Jesse Grossman, CEO of New Jersey-based Soltage. “2017 saw a number of challenges to the solar sector, with the uncertainty of the trade case, pending tax reform, and a rationalization of business models in some parts of the residential sector.”

“The emerging development models in the utility-scale and commercial segments continued to show strong growth, however, and I expect that growth to continue again in 2018,” Grossman added.

In all, the U.S. Solar Market Insight report is, as was likely expected, a mixed bag for the industry. But despite its struggles, the solar industry persisted. And sometimes, that’s all for which you can ask.