Top 10 Solar States to Watch

Where are homeowners most interested in residential solar power?By Scott Mueller, Special to SolarWakeup

Residential solar is the fastest and most steadily growing market segment with year on year growth well over 50%.

Over the last few years the solar industry has come a long way, as illustrated in the recent SEIA US Market Report. Numerous residential solar installation companies pepper the Inc. 5000 fastest growing companies list, and the successful IPOs of SolarCity and forthcoming Vivint Solar reflect this growth and optimism. We think the best is yet to come.

The megawatt question is where will we see new residential solar growth in the coming year?

In states like California the right mix of policy, market conditions, and consumer interest show how the market can grow quickly and sustainably, and California shows no real signs of slowing. As solar begins to reach the mainstream, and 92% of Americans want more solar, we all want to know which states represent the next wave.

So we did a little data crunching on our own residential solar lead data from the last eight months. We call it the “US Solar Combine”, where States are ranked in three events:

- “Strength” – Top states by total solar lead volume

- “Passion” – Relative interest level in solar power (ratio % of leads/% of population)

- “Speed” – Fastest rate of solar lead growth in the first 8 months of this year.

Then we took an aggregate score of all three events to crown the overall champion. You’ll be surprised to see how they stack up.

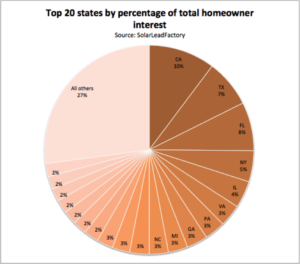

#1. STRENGTH: Top State by Total Lead Volume

The first test is brute strength—who’s got the most interested homeowners?

Here we’re looking at the relative percentages of residential solar leads by state in the USA, which is of course heavily influenced by population (bigger states will generally have more leads). So the Golden, the Lone Star, the Sunshine, and the Empire states live up to their big names and take the crown as the strongest states by lead volume.

But if California represents about 50% of the residential solar market and only 10% of the lead volume (much more in line with population), then doesn’t this say that people across the country are roughly equally interested in solar? We think that with the right long-term strategies in place, Texas, Florida, and New York would easily rise to become some of the major markets. New York is already taking big steps to become a major solar market, while Florida and Texas have alternated between glimpses of their true potential and stumbling. The people have spoken, so let them have solar.

Winner: California, the Golden State

Runner-Up: Texas, the Lone Star State

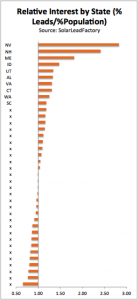

#2. PASSION: Top ranked states by “interest”

The second test is more nuanced—what state has the most solar passion?

It’s not surprising that California is the largest lead volume state, so we needed a measure of how many people are saying, “I want solar,” compared with that state’s population. The higher the score, the greater the relative interest level in solar.

This is calculated as % of residential solar customers divided by % of population. This is an indication of the latent demand for solar, with “1” meaning equal percentages of people want solar and who live in that state (e.g., (10% of the total leads) / (10% of the US population is in that state) = 1). Simply stated, the greater the value, the higher the concentration of people who want solar.

Nevada, New Hampshire, and Maine have a much higher proportion of people that are interested in solar than say New Jersey or Louisiana. While there are robust solar markets in states with lower “solar passion scores,” this test points out some of the true outliers in public opinion.

Winner: Nevada, the Silver State

Runner up: New Hampshire, the Granite State (or Live Free or Die)

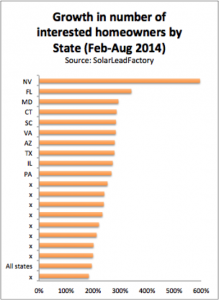

#3. SPEED: And the fastest growing states are…

The third test was outright speed—which states are seeing the fastest rate of lead growth?

The more mature markets saw rapid growth; in fact, over the first half of the year, interest in solar as seen by number of residential solar leads has almost tripled! But some markets are clearly winning the 40-yard dash: Nevada was the Usain Bolt of solar interest with an almost 600% increase in interested homeowners from January 2014 to August 2014. Florida was well over 300% growth, and all of the top 10 states clocked in over 250% growth. And all of the states with a significant lead volume at least doubled in lead volume. This is pretty monumental and suggests that indeed the biggest solar wave is yet to come.

Winner: Nevada, the Silver State

Runner Up: Florida, the Sunshine State

RESULTS: Combined scores in each of the three disciplines

So far we’ve seen California take the crown as the “Strongest” state, but Nevada had the most “Passion” and was also the “Fastest.” As with any combined event, it’s all about how you did in as many events as possible. The results of our three disciplines and the combined ranking are posted in the table below as well as how SEIA ranked the states in 2013.

Nevada, the Silver State, eked out the first place position by winning two out of three events. However, Florida, the Sunshine State, managed to snag second place based largely on their strength (third, just behind Texas) and speed (second). To boot, Florida ranks third in terms of solar potential in the USA (according to SEIA). California lands in third, just barely edging out Texas. Virginia wraps up the top five, with Illinois, New York, Maryland, North Carolina, and Pennsylvania rounding out the top ten.

With over half of all residential solar installations in California, new state markets represent the next major growth opportunity for a sustainable, healthy, and growing U.S. solar market.

This data was collected and analyzed by Solar Lead Factory, a solar-focused residential lead generation business leveraging online marketing strategies. The analysis here was based on a data segment of comprehensive US-based web traffic.