By Frank Andorka, Senior Correspondent

In case you’ve been living under a rock, there are elections coming up in a little less than a month. In nine states, there are contested races for governor. If you’ve been wondering how your candidate stacks up on clean energy issues, national business group Advanced Energy Economy (AEE) launched online scorecards to help you out this election season.

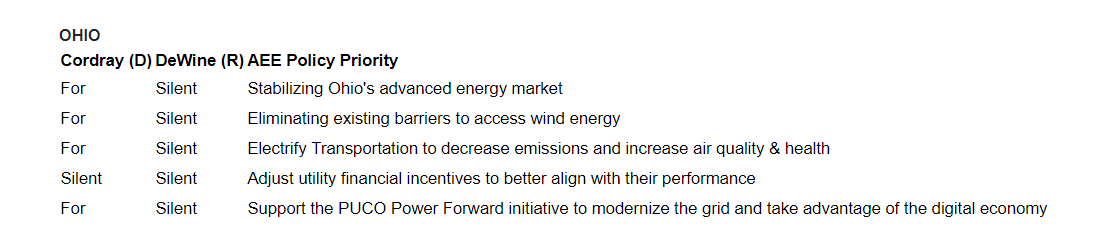

AEE will update candidates’ policy stands based on public statements and policy platforms adopted by Republican and Democratic nominees leading up to Election Day on Nov. 6. The project will be supported by targeted digital advertising in the nine states to help voters learn more about the energy policies of gubernatorial hopefuls.

Tracking and reporting policy positions of election candidates is the latest step in a nearly yearlong effort to engage with gubernatorial candidates to discuss the positive economic benefits of advanced energy and offer policy ideas for expanding advanced energy markets in each state. AEE has reached out to every nominee in the nine states for roundtable meetings with member companies, has shared its policy priorities, and released new data on advanced energy jobs. Nationally, the advanced energy industry employs 3.4 million U.S. workers.

“Ensuring that candidates for governor appreciate the benefits that advanced energy can bring to their states, namely economic development and good jobs, has been a key focus of Advanced Energy Economy this year,” said J.R. Tolbert, vice president, state policy, at AEE. “We have found the candidates to be receptive to our message and hearing from the companies working in their state, with the result that a bipartisan slate of gubernatorial candidates across the states has adopted at least one of our priority positions.”

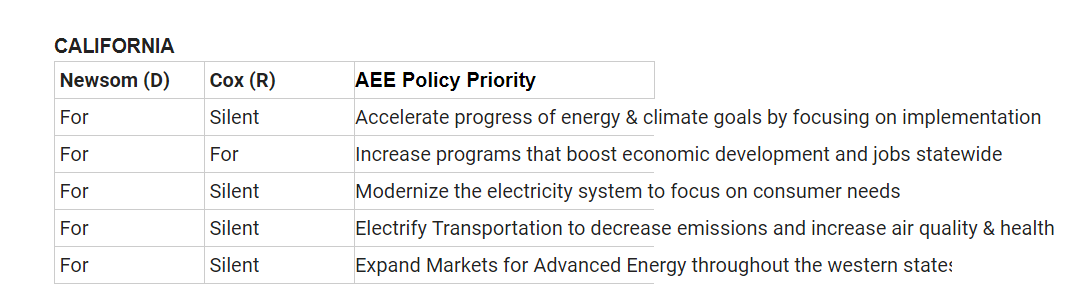

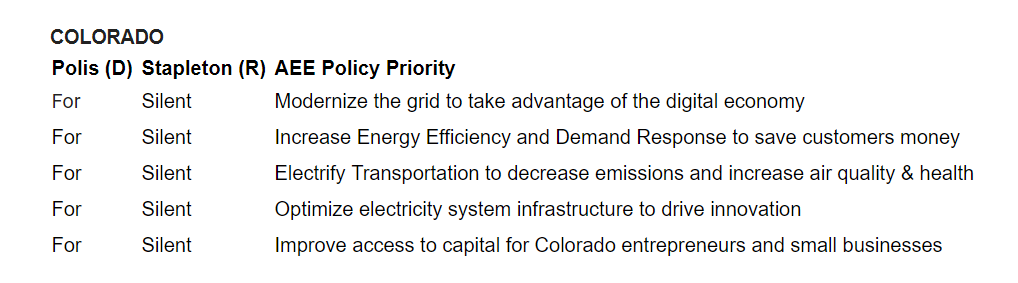

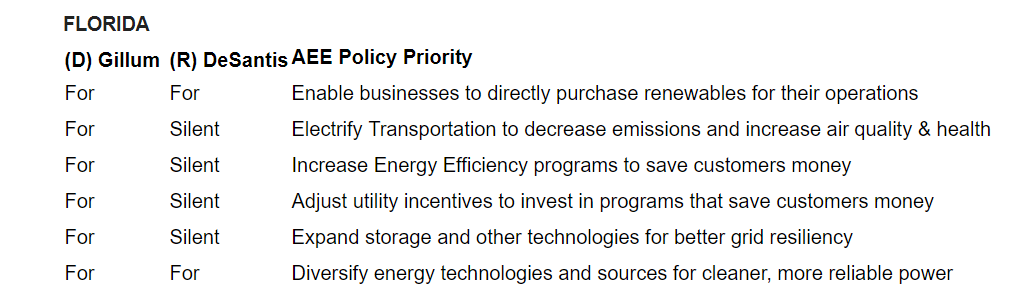

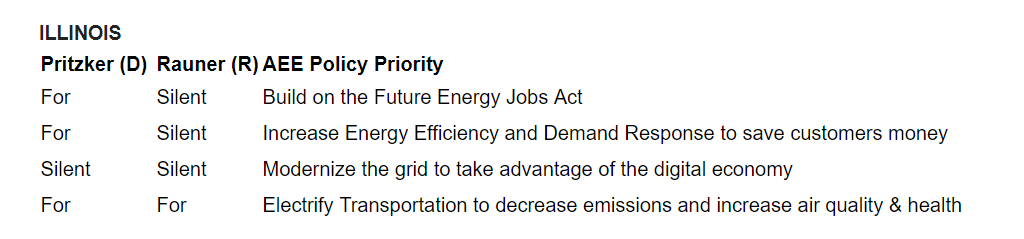

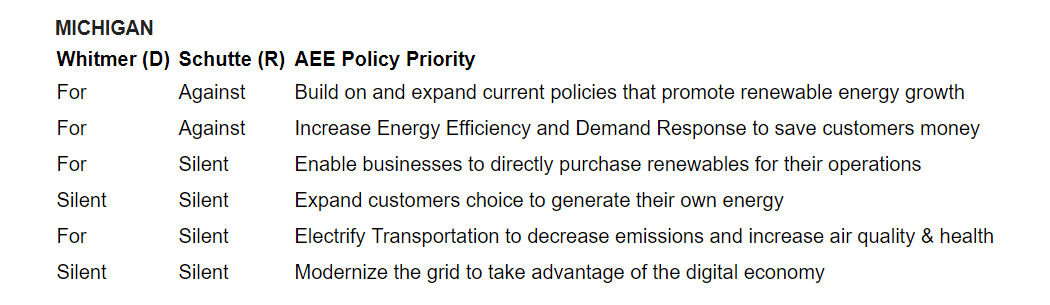

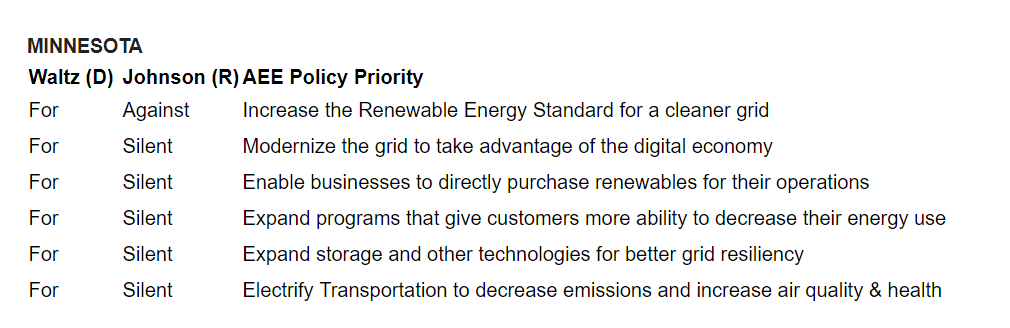

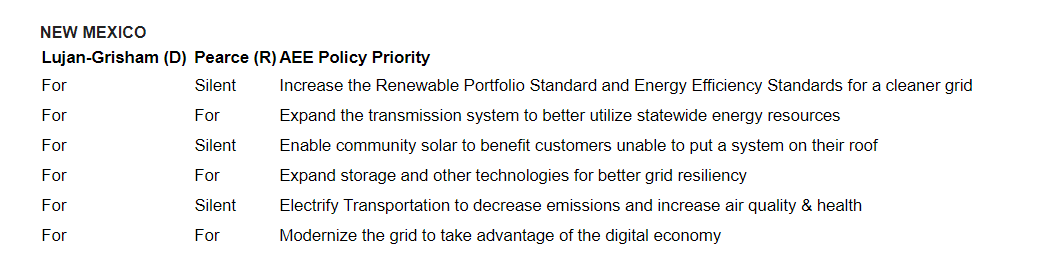

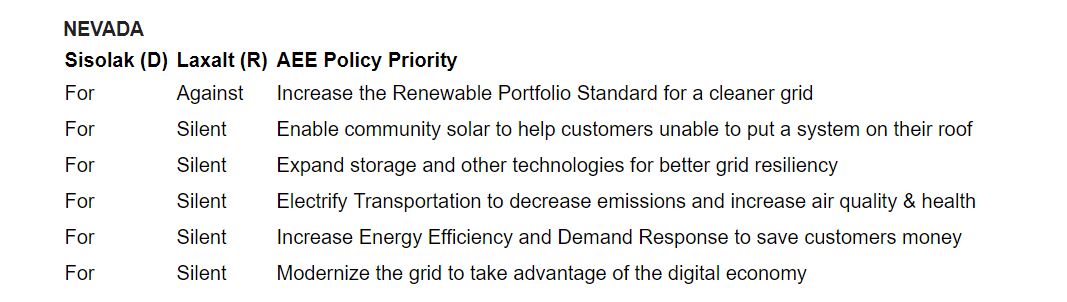

The following are summaries of what AEE found as they canvassed election candidates on both sides of the aisle concerning where they stood on a host of clean energy issues. For all of the races, Democrats tended to side with AEE’s policy recommendations, while Republicans either opposed them or were silent on them (with a few exceptions, as you’ll see below).

Far be it from SolarWakeup to tell you how to vote, but the message is clear if you’re interested at all in building a clean energy future. Judge for yourself from the information below – and then vote accordingly.

SCORECARD SUMMARY