SunShot Is Proof That Venture Capital Is Missing Out

By Yann Brandt, Managing Editor of SolarWakeup

On a day when the Wall Street Journal sings the praise of how much capital is flowing to solar companies like SunRun and Sungevity, Minh Le, director of the Solar Energy Technologies Office, stands before a group of over 800 participants of the SunShot Summit. As the Department of Energy helps solar companies across the country cross the proverbial valley of death, the success rate is remarkably high. So high in fact, it appears that the data is showing venture capital that early stage solar makes financial sense.

On a day when the Wall Street Journal sings the praise of how much capital is flowing to solar companies like SunRun and Sungevity, Minh Le, director of the Solar Energy Technologies Office, stands before a group of over 800 participants of the SunShot Summit. As the Department of Energy helps solar companies across the country cross the proverbial valley of death, the success rate is remarkably high. So high in fact, it appears that the data is showing venture capital that early stage solar makes financial sense.

$1.8 billion dollars of direct corporate investment for SunShot award winners is the statistic and that does not include the project finance capital used to invest in projects which brings the total to over $3 billion. Regardless of the success of SunShot, there is little doubt that investors are not doing early stage investing in the space. A fact clearly pointed out by Rob Day of Black Coral Capital in his recent piece. Rob knows what he is talking about; his twitter handle is @cleantechvc.

Let’s point out the reasons that SunShot is having success and why there is much more room for VCs to participate in this market. Having the private market replacing the Department of Energy is a reality that top brass at SunShot are hoping for, they do not, in fact, want SunShot to be the early stage investor in the space if the private market is willing to take over.

SunShot has a public goal of bringing solar costs to $0.06 per kWh, which according to the recent procurement by Austin Energy of $0.05 per kWh is already happening but not for the everyday market. The goal is listed as 60% accomplished and the outlined path includes many different parts of the market, creating investment opportunities for all types of venture capitalists.

SunShot has a public goal of bringing solar costs to $0.06 per kWh, which according to the recent procurement by Austin Energy of $0.05 per kWh is already happening but not for the everyday market. The goal is listed as 60% accomplished and the outlined path includes many different parts of the market, creating investment opportunities for all types of venture capitalists.

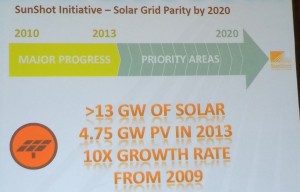

Solar is a huge market, growing 10x since 2009. It also retains many inefficiencies in the soft cost side of the development structure. An important factor since many VCs look at solar as a sector where they took a beating in the past investing billions in big manufacturing plants. Soft cost inefficiencies are addressable by “3 founders and an iPhone app” according to one panelist at the summit, meaning it is not a capital intensive endeavor. The appetite for soft cost reduction is also there as companies continue to partner and acquire whenever possible.

Solar is a huge market, growing 10x since 2009. It also retains many inefficiencies in the soft cost side of the development structure. An important factor since many VCs look at solar as a sector where they took a beating in the past investing billions in big manufacturing plants. Soft cost inefficiencies are addressable by “3 founders and an iPhone app” according to one panelist at the summit, meaning it is not a capital intensive endeavor. The appetite for soft cost reduction is also there as companies continue to partner and acquire whenever possible.

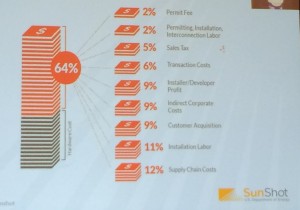

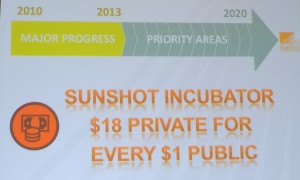

Soft costs represent 64% of the cost structure according to the SunShot team and that is the opportunity the market with the help of venture capital could and should address. SunShot is accepting approximately 5% of applicants, lower than Harvard but higher than current VC investment in the space. With $1.8 billion in follow on investment, a SunShot syndicate portfolio would surely represent a healthy return to VC limited partners. In simple terms, SunShot says the private investment has been $18 for every $1 of their public investment. Let’s assume a conservative $3.6 billion in valuations (aggregate) and the return to a $100 million ‘fund’ would be quite impressive.

Soft costs represent 64% of the cost structure according to the SunShot team and that is the opportunity the market with the help of venture capital could and should address. SunShot is accepting approximately 5% of applicants, lower than Harvard but higher than current VC investment in the space. With $1.8 billion in follow on investment, a SunShot syndicate portfolio would surely represent a healthy return to VC limited partners. In simple terms, SunShot says the private investment has been $18 for every $1 of their public investment. Let’s assume a conservative $3.6 billion in valuations (aggregate) and the return to a $100 million ‘fund’ would be quite impressive.

The success rate is proven by the SunShot experiment. Can the investment community look at solar, particularly very early stage, as a valley of opportunity instead of the proverbial valley of death. SunShot is doing its part to de-risk but we cannot expect that to last forever.